Insurance Inspections

Wind Mitigation Inspection

Wind mitigation inspections are generally required by all insurance companies with the purchase of a home. Wind mitigation inspection reports cover seven different aspects of your homes construction and features.

The inspection will identify the following:

1. Building Code

When the home was built and what building standards it was it constructed to.

2. Roof Covering

The type of covering, when it was installed and the installation method.

3. Roof Deck Attachment

The type of deck material and the method of attachment.

4. Roof to Wall Attachment

The WEAKEST type of roof to structure wall attachment.

5. Roof Geometry

The shape of the roof, based on parameters given in the report guide lines.

6. Secondary Water Resistance (SWR)

Is a form of qualified SWR installed?

7. Opening Protection

The WEAKEST form of wind born debris protection for all types of windows and doors.

A Wind Mitigation Report will help you take advantage of the cost savings benefits determined from these seven different aspects of your home. Best Inspect will ensure you have the proper documentation to get the insurance credits you deserve. Best Inspect can also help you identify the most cost effective ways to make improvements that will increase your savings.

Four-Point Inspection

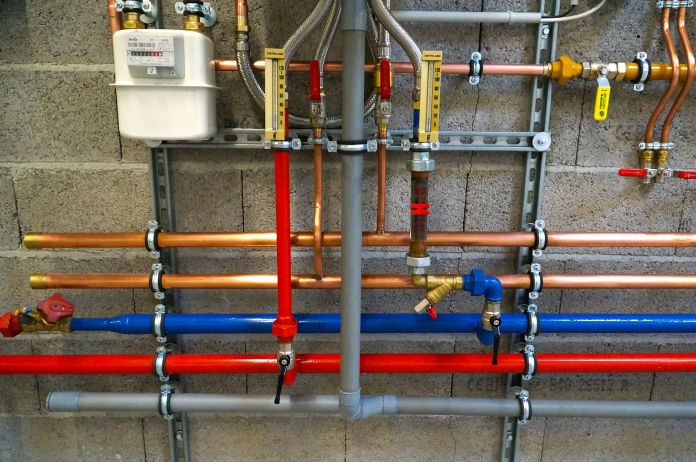

Four point inspections cover four main components of the home. These include:

1. Roof

2. Plumbing system

3. Electrical system

4. Heating and Air systems (HVAC)

A four point inspection report is generally required on homes 20 years old and older. Every insurance company has their own guidelines and requirements. Some underwriters may require this report regardless of age. Your insurance agent can advise you as to whether or not you will be required to submit a certified four point inspection report with your insurance application. Best Inspect will ensure you have the proper documentation required by your insurance company.

Roof Inspection

A roof inspection (formerly known as certification) is confined to the roof of your northwest Florida home and will identify the following:

1. Type of roof covering material

2. Age of the roof.

3. Remaining useful life of the roof

4. Overall condition of the roof

As with the four point inspection, this report may be required by your insurance company. Every insurance company has their own guidelines and requirements. Some underwriters may require a roof inspection. Your insurance agent can advise you of whether you will be required to include a roof inspection report with your insurance application. Best Inspect will ensure you have the proper documentation required by your insurance company.